Six months later, we recognized the design didn't work as plannedwe predicted 3 new salesmen would translate to new earnings of $1 million, however we only had earnings of $500,000. In order to comprehend what went incorrect, I examined every action of the analysis and spoke to all the stakeholders individually about what, from their point of view, had caused the mismatch in between our forecast and truth. I learned in that procedure that we had made some problematic presumptions about ramp-up time and how lots of consumers freshly onboarded salesmen could close per sales cycle. In future models, we made certain to loop in those stakeholders earlier and to dig into a lot more granular detail to evaluate our presumptions from every instructions and make certain we weren't missing out on anything." Reporting is usually a huge part of a monetary expert's task, and the reporting needed will depend on the role.

In your answer, they'll be searching for technical abilities in addition to partnership abilities, interaction, company, follow-through, and time management. Answering this concern is about providing examples of what you have actually carried out in your existing or previous positions, consisting of not just the specific software application and methodologies you use, but how you engage with people at the company to truly understand the requirements they're looking for. Articulate the idea process you would go through to comprehend those requirements and after that discuss how you would perform the task and follow through on your obligations. For best outcomes, take a deep dive on one example and Helpful site go into as much detail as possibleinterviewers might follow up for more examples, however your first example needs to take them through the whole procedure.

They may ask you to walk them through Visit this website an earnings declaration, a balance sheet, a declaration of shareholders' equity, and/or a capital statement. Or they may ask you a concern like this so you can reveal that you not just understand the declarations but comprehend when and how to utilize them. The very best response here is not simply to select the monetary declaration you prefer, but also to talk about why you believe it's the most useful source of info for a certain type of scenario and address why the other monetary declarations might not be suitable options. A response to this concern may look like this: "I choose to utilize the cash circulation statement to make a decision on a business, particularly if I'm attempting to obtain how a company is doing in a moment of trouble or crisis.

A balance sheet will only reveal you the possessions and debt of the company at a point in time, and investor's equity just reveals you what's been paid into the business and what exists internet of properties and liabilities. The income declaration has a lot of informationrevenue, expense of items and services, and other expensesbut I find the capital statement most useful for evaluating a business's overall health in the short-term." The employer is looking for your idea process as you compare and contrast wesley financial bbb different appraisal methods. This assists an interviewer see that you're familiar with multiple financial principles when it comes to equip valuation which you comprehend the advantages and disadvantages of different types of methodologies.

But you should be prepared to walk recruiters through how you concern a response on any kind of process concern you receive. Walk the recruiter through your idea process in selecting the metric you prefer and discuss what it can tell you about the stock and how that would help you evaluate a company - What is a consumer finance account. You can likewise mention other metrics in your response to assist you explain why the one you chose is better or what secondary metrics you 'd choose if you might add others to support your main choice. An answer to this question might appear like this: "Of the three most typically used appraisal methodologies, marked down money flow, equivalent business analysis, and precedent deals, I believe that equivalent company analysis is the most helpful throughout all different kinds of business and markets.

A low P/E ratiowhen compared to similar companies and stocksmight be a sign that the rate of that present stock is affordable relative to the company's earnings, while a high P/E ratio might indicate that the stock's valuation has become expensive specifically if it's higher than others in its comp set (How to finance a franchise with no money). It is necessary to note that one methodology or ratio typically does not tell a complete story by itself and others need to be utilized for a more holistic technique, however I believe P/E ratio comp analysis offers the least space for variability." This is another question in which an employer wishes to comprehend how you do things.

The Greatest Guide To What Is The Reconstruction Finance Corporation

They desire to see if you understand how to determine a net present worth and discount capital - How to finance a home addition. You might have to do some math, especially if a business gives you a specific problem to solve. Be prepared to walk the interviewer through your idea process. "I had a concern like this when I was interviewing," says Nathan Atkins, an investment banking expert at M&T Bank. "They asked, 'We want to buy a greater quality leather for our seats in a cars and truck; it's going to cost X amount of dollars to do it, and we need it to return Y, so is this a great investment?'" For example, a response may look like this: "Net present worth is a great model for forecasting, since it finds the distinction in between today value of cash inflows and today value of cash outflows over a period of time.

You 'd take capital, divide it by one plus your hurdle rate to the power of the time duration, subtract your initial investment and that would give you your net present value. How to find the finance charge. What this need to tell you is the value today of this future stream of payments. As long as it's positive, that indicates the task is worth doing." There's technical understanding connected with a task as a monetary analyst, and you'll be anticipated to understand and understand it. Fortunately, this isn't the part of the interview that the majority of monetary expert candidates find difficult. "The presumption is that the majority of people applying for a financial expert job would comprehend the basics of finances, so those are concerns that the majority of prospects are going to get right," Jaffee states.

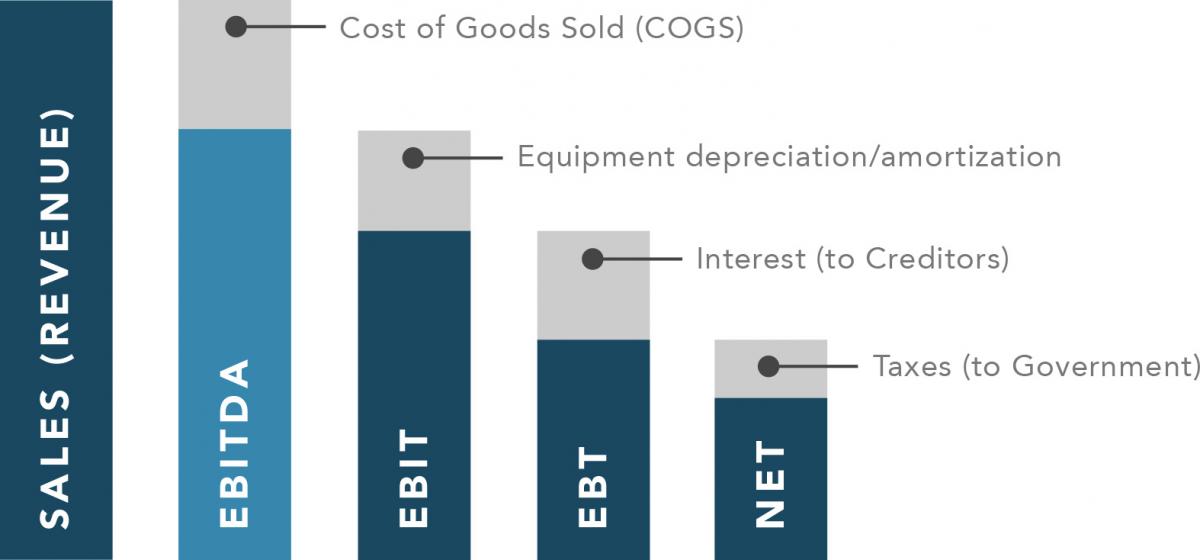

You may be asked to analyze a spreadsheet, checked out a financial statement, discuss how you 'd solve an issue in Microsoft Excel, or describe a financial term (like positive money flow), to name a few things. In this case, you should discuss the principle of EBITDAstarting by defining what the acronym refers toand ensure you likewise state why it's an important metric in examining a business's monetary health. For circumstances, your response may be: "EBITDA stands for Incomes Before Interest, Taxes, Devaluation, and Amortization, and essentially, it's a measure of net income with interest, taxes, depreciation, and amortization included back to the overall.